Blog

Click here to go back

5 Ways to Manage the New Entertainment Deduction Rules in 2018

5 Ways to Manage the New Entertainment Deduction Rules in 2018

2018 brought changes to the entertainment deduction rules. We want to ensure that you’re not scrambling to meet these new standards. Before you find yourself stuck financially, let’s review these new rules for 2018.

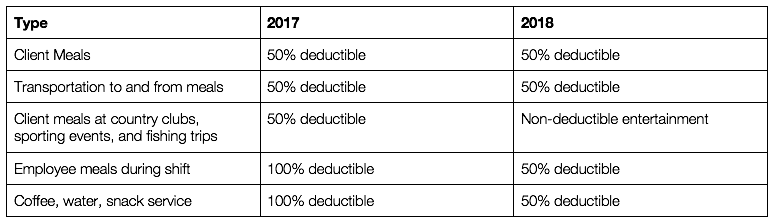

Meals

You know the drill: You’re out to dinner with a client or co-worker discussing work and you file away your receipt to pass on to your accountant for a tax deduction. 50% of these business-related meals — as long as they’re truly business-related meals — are still deductible, as well as transportation to and from restaurants for work-related meals. But the new law states that these meals can no longer take place at nightclubs, cocktail lounges, country clubs, sporting events, or on fishing trips. So keep your clubs secure and your fishing rods stowed if you want those deductions in 2018.

What about the meals employers provide to their employees during an employee’s shift? What about coffee, water, and snack services? These used to be 100% deductible, but as of January 1, 2018, they’re only 50% deductible. (And after 2025, you won’t be able to write them off at all.)

Tips for Best Practice: On your receipt, write the business topic discussed and the individuals who were present at the meal. It’s important to do this because in the event of an audit, the auditor may disqualify any meal expenses that aren’t properly documented.

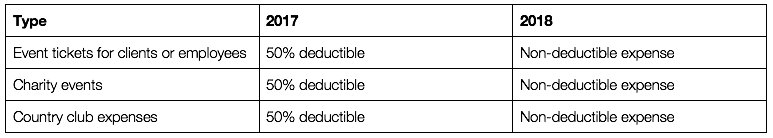

Events

Event tickets and club memberships are great gifts to your favorite clients, or perks for your employees. Half of these expenses used to be eligible for a write-off, but with the new laws in place this is no longer possible. And yes, this even applies to tickets to qualified charitable events. So say goodbye to the skybox unless you can spring for it without the deduction perk.

Tips for Best Practice: We realize that club memberships are often a great way to socialize on behalf of your business. Under the new rules, it may be more financially beneficial to become a sponsor for an event instead. Often, these types of sponsorship expenses can be written off as advertising. If this is something you’d like to consider, let’s talk about the options available to you.

Employee Perks

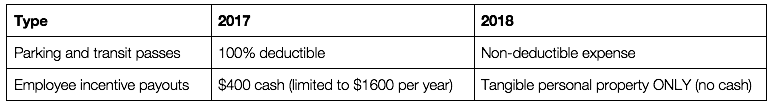

There are many employee perks that can also benefit your taxes. We’re only covering parking and incentive payouts here, but if you’re looking for additional options, give us a call.

In 2017, employers were allowed to write off all the parking permits and transit passes they handed out to employees. The new law states that employees can exclude the perk from their income, but companies can no longer write off the expense.

2018 brought changes to employee incentive payouts as well. In 2017, each award was deductible if it was under $400 cash and an employee was awarded no more than $1,600 per year. Awards can still be granted, but you can no longer award with cash or gift cards. 2018 laws say these items must be tangible personal property instead.

Tips for Best Practice: If you’re a company paying for employee parking downtown, you need to be aware of all that is involved so both you and your employees are coming out ahead. Contact us and we’ll help you evaluate these costs.

Documentation

As a reminder, document, document, document. 2018’s entertainment deduction rules on documentation haven’t changed. The rules still require you to document the date of any client meal, who was present, and what business was discussed. If you can’t substantiate your deductions, you won’t be allowed the tax deduction.

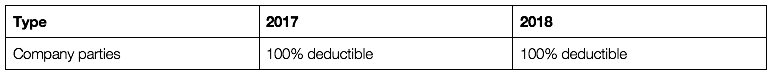

Company Parties

Company parties are still 100% tax deductible. (Summer picnics, too!) So while your employees might not get there on a tax-deductible transit pass, your end-of-the-year party can still benefit your tax situation. In fact, it may be the last chance of the year to wedge in as many write-offs as possible.